Moving Average Scalping Strategy Skyrocket Your Profits With This TimeTested Approach

Moving averages are a frequently used technical indicator in forex trading, especially over 10, 50, 100, and 200 day periods. The below strategies aren't limited to a particular timeframe and.

Top 5 Best Scalping Indicator for MT4 (Download Free)

November 24, 2023 Futures are leveraged derivative exchange-traded financial instruments that traders can use to take advantage of movements in the underlying market. Scalping futures can be an.

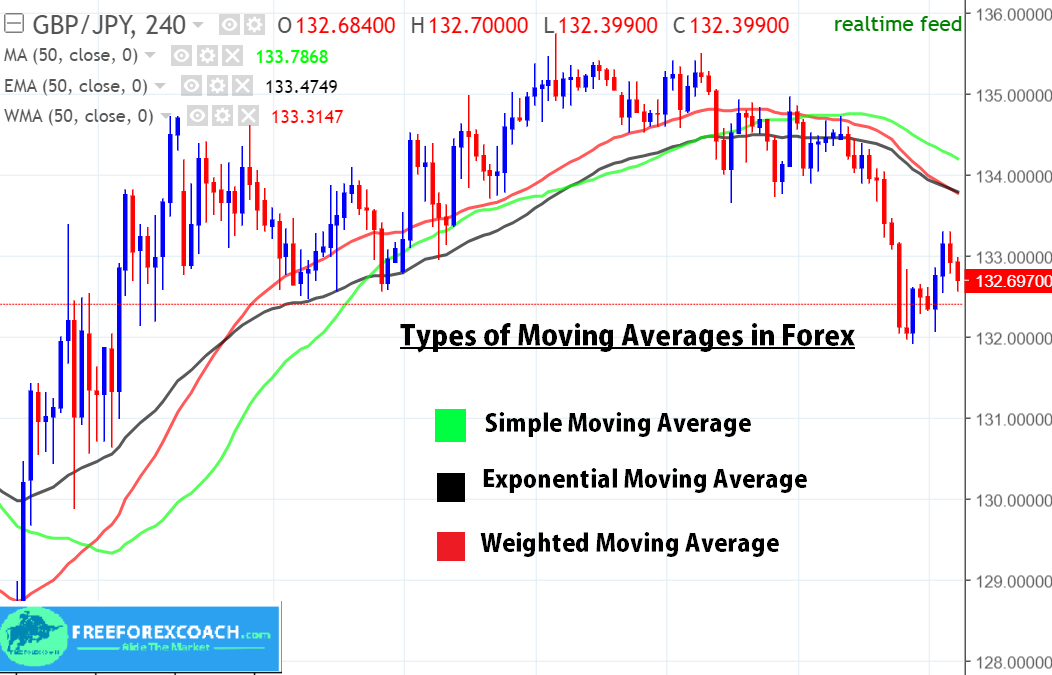

Types of Moving Averages in Forex Free Forex Coach

It involves making a high volume of trades that aim to capture small profits from these price fluctuations. In this article, we will discuss five of the best forex scalping strategies that actually work. 1. Moving Average Crossover Strategy: The moving average crossover strategy is one of the simplest and most effective forex scalping strategies.

What is the Popular Moving Average Scalping Strategy?

Scalp trading using the moving average. Another method is to use moving averages, usually with two relatively short-term ones and a much longer one to indicate the trend. In the examples below, on a three minute EUR/USD chart, we are using five and 20-period moving averages (MA) for the short term, and a 200-period MA for the longer term.

1 Min Easy Forex Scalping Strategy

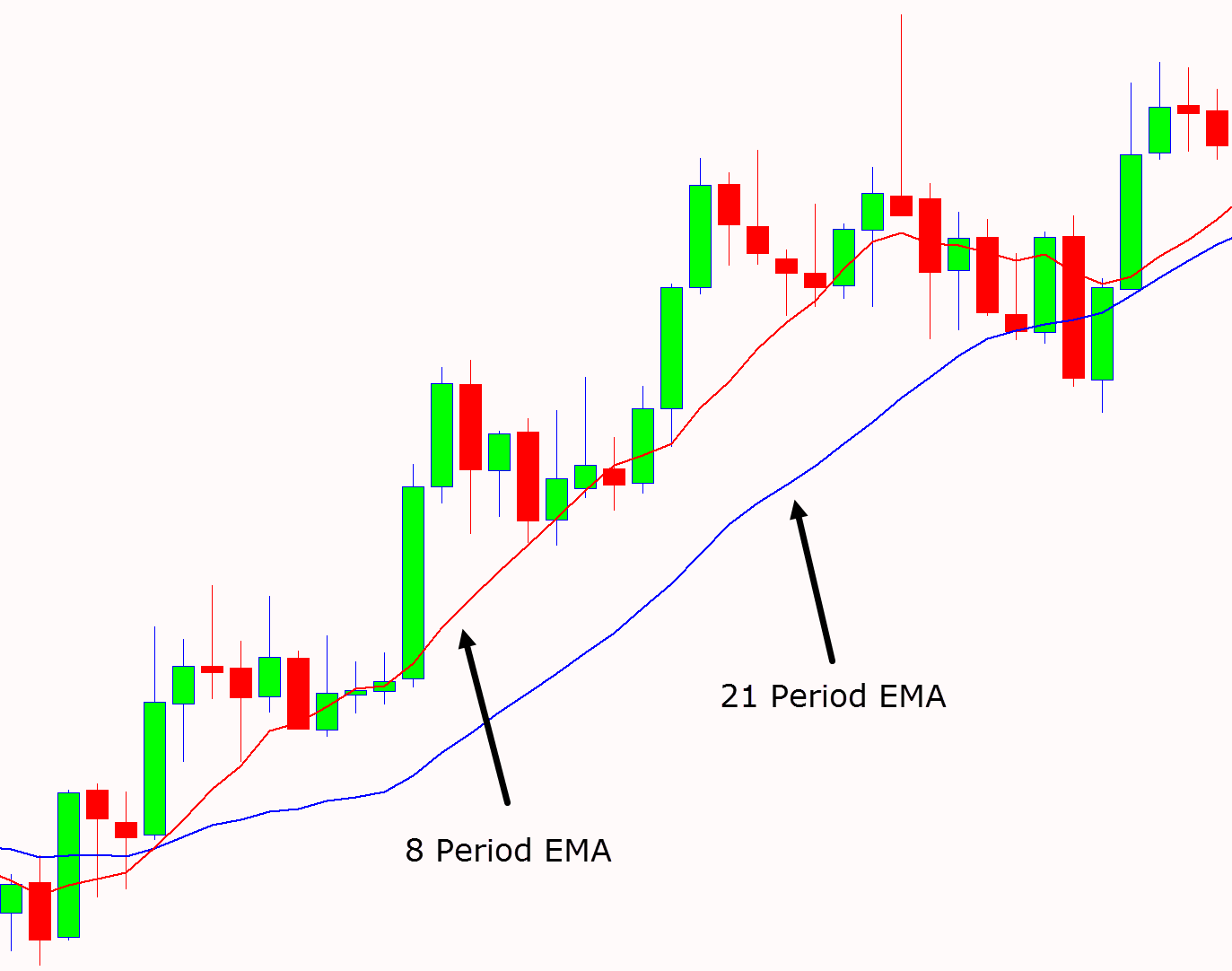

Best EMA for Scalping: Moving Average (EMA) Scalping Strategy Main · Strategies · Scalping Strategy with Two Moving Averages (EMA): Description and Rules Scalping Strategy with Two Moving Averages (EMA): Description and Rules 08.05.2020 4 minutes for reading Contents What is scalping? Description of the strategy Strategy trading rules

Best Moving Average for 1 Minute Chart Scalping Forex

Simple Scalping Strategy Using Moving Averages 22 March 2022 Last Updated: 14 July 2023 A Forex scalping strategy is a fast-paced trading style that involves placing several trades a day. Scalping strategies are traded on the smallest time frames and positions are held for only a matter of minutes.

Forex Scalping Strategy With Exponential Moving Average

Best Moving Average Settings For Scalping Author: The Forex Geek | Published: April 19, 2023 Table of Contents Moving averages are widely used technical indicators that can help you identify trends and potential entry and exit points for your trades.

Forex Multi Moving Average Scalping Strategy ForexMT4Systems

The faster moving average reacts more quickly to price changes, while the slower moving average provides a broader view of the trend. The most commonly used combination is the 10-period and 20-period moving averages. When using the moving average scalping strategy, traders look for two key signals: 1.

Moving Average 1 Minute Scalping Strategy [ EMA + Price Action + Momentum ] YouTube

How to Scalp Trade A scalp trader can look to make money in a variety of ways. One method is to have a set profit target amount per trade. This profit target should be relative to the price of the security and can range between .1% - .25%.

Forex Moving Average Scalping Strategy Forex Millennium System

906 4 The main goal of a scalping strategy is to open and close trades frequently, profiting from small gains and limiting the downside risk. This strategy, on average, manages to close trades within one day, meaning that you are not exposed to the risk of holding that coin for long.

Moving average scalping strategy Best forex trading system YouTube

Moving Average Ribbon strategy. This scalping strategy involves the use of several EMAs with different time frames. For example, scalpers generally use 10 EMA, 20 EMA, 50 EMA, and 100 EMA. The EMAs are then plotted on the chart in a ribbon-like formation, running parallel. This ribbon can be used to identify the direction and momentum of the trend.

Forex Scalping Strategy and the Best Moving Average for 1 Minute Charts

To use moving averages effectively in scalping, traders should consider using multiple moving averages with different periods. For example, combining a 50-period SMA and a 20-period EMA can provide a strong indication of the overall trend while offering more precise entry and exit points.

Moving Average Strategy in 2020 Moving average, Strategies, Forex

Scalping is a trading method that makes a specialty of making profits on small price changes as soon as the price has emerged as profitable. Scalping reaches consequences with the aid of growing the variety of winning trades by sacrificing the size of the wins.

How Forex Market Moves Fast Scalping Forex Hedge Fund

The moving average scalping strategy is a time-tested approach that can skyrocket profits in short-term trading. By leveraging technical analysis and utilizing the power of moving averages, traders can capture quick gains and capitalize on intraday price movements in forex and stocks.

Scalping Trading Strategies With PDF Free Download

Let's take a look at the 3 main steps of our 1-minute Forex scalping strategy. Step 1: Identify the short-term trend The two moving averages are used to identify the current trend in the 1-minute timeframe.

What is the Best Forex Scalping Strategy? The Forex Geek

Scalping is a trading strategy that involves a high number of opened trades focused on smaller profits. Essentially, scalpers believe that it's easier to profit from smaller market moves. Ultimately, many small profits can result in large gains if a strict exit strategy is used.